-

Nature of business

-

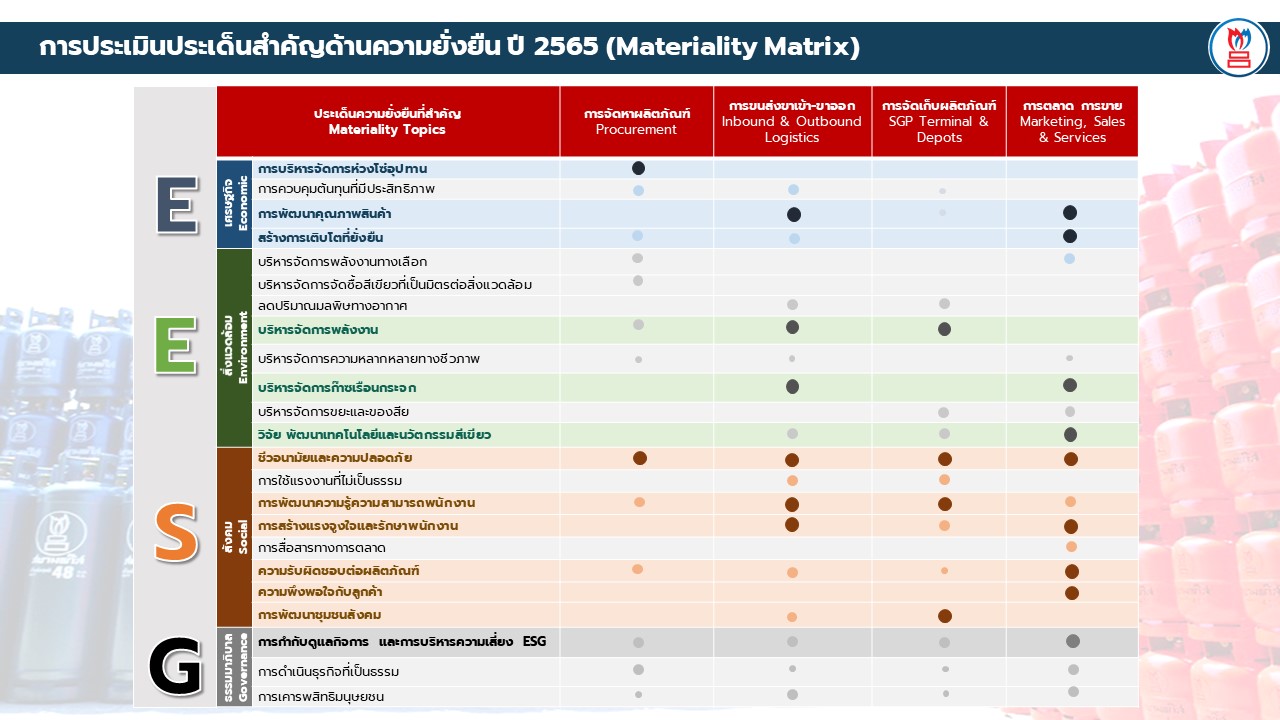

Business structure

-

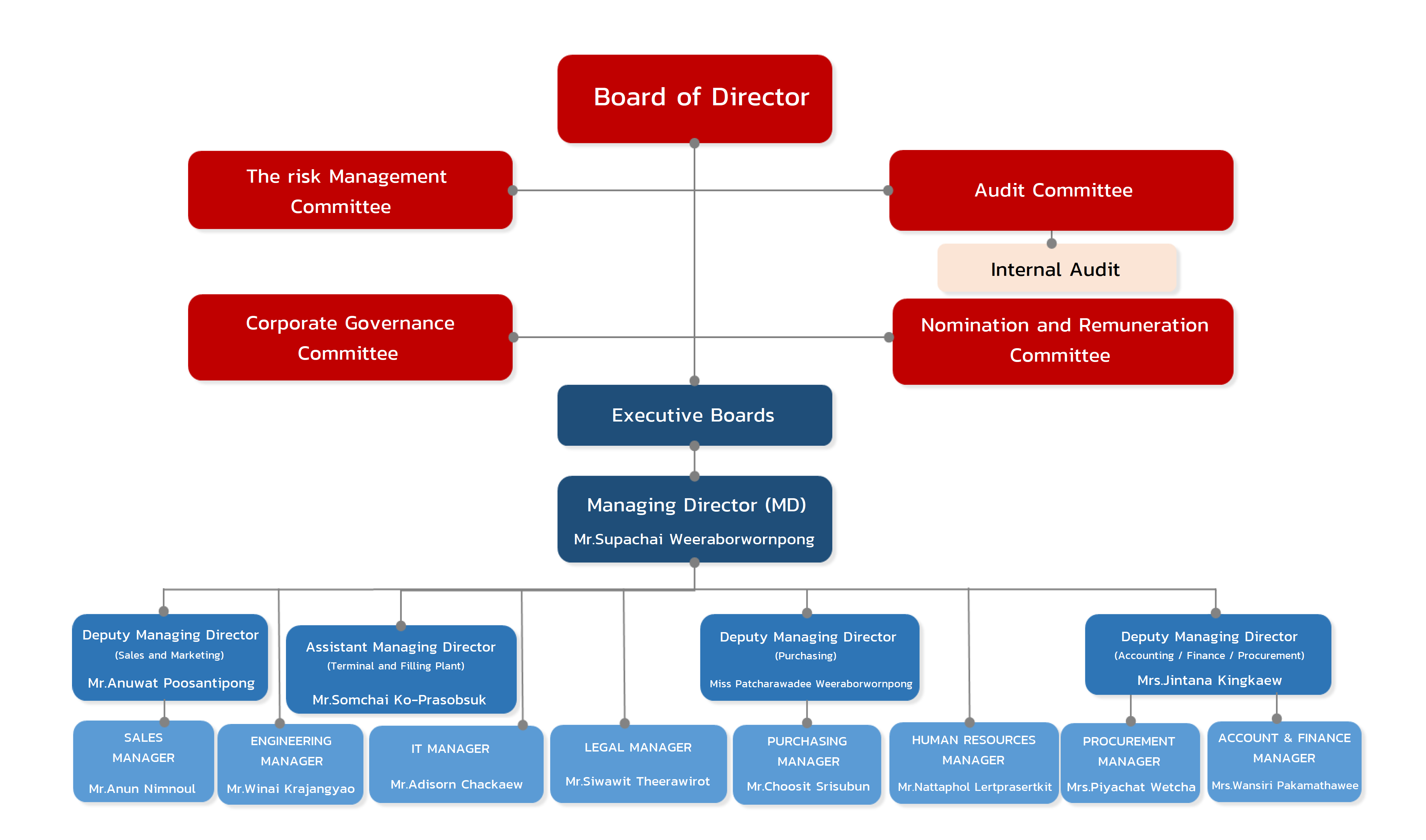

Corporate governance

-

Message from chairman

-

Disclosure Policy

-

nature of business

Liquefied Petroleum Gas (LPG) is widely used and is important in daily life. It is called a “green” fuel as it decreases exhaust emissions and thus is environment-friendly. Bearing in mind that LPG consumption has witnessed a steady growth each year, the Executives of the Company, with more than 40 years of experience are keenly attentive to the fuel’s vital role. As a leader in the market, the Company affirms its commitment towards incessant development to respond to the growing demand and the expanding market.

The focus lies on efficiency in distribution of LPG nationwide. With aim to expand several LPG terminals, depots and filling stations in all areas of the country. Safety, reliability and quality assurance are like blood through its veins as customer satisfaction is the top priority. The Company also provides safety, technical and engineering consultation services for customers of all levels.

Life is a never-ending journey, so is the Company’s plight to success. Overseas investment especially Asia, has been given a priority mission in recent years as strategy to strengthen itself and its subsidiaries’ business base.

-

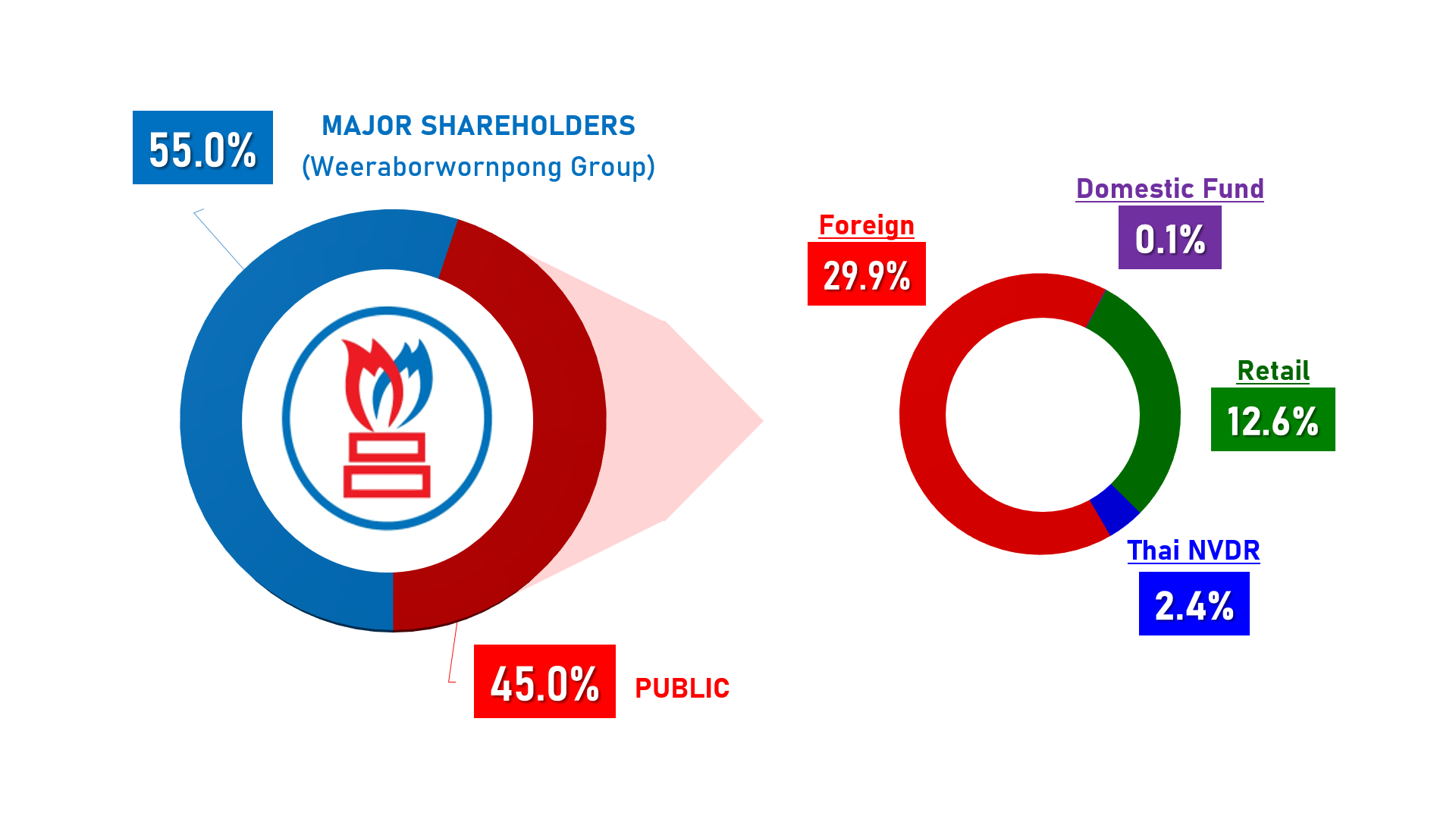

Equity chart

-

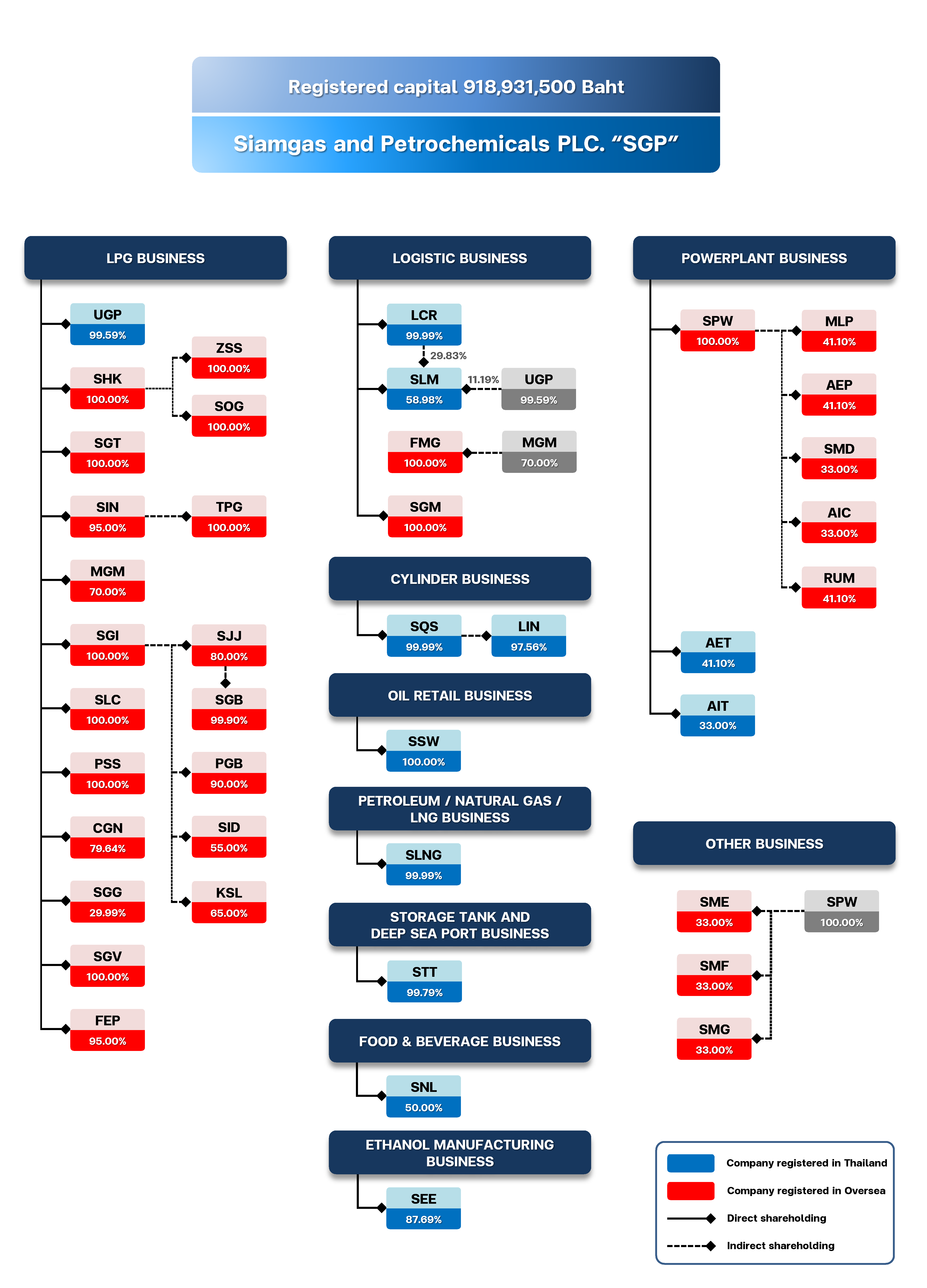

Company structure

-

Organization chart

-

Board of director

-

Management

BOARD OF DIRECTOR

Mr.Worawit Weeraborwornpong - Chairman and Director with Authorized Signature

Started on 12 January-2006

Age : 77

Educational Credential

• An honorary doctorate of Rajamangala University of Technology Thanyaburi

• Bachelor’s degree of Bangkok Thonburi University

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Board Member/Management in Listed Company

• None

Position in Other Company

• Director | WW HOLDING COMPANY LIMITED

• Director | FAREAST MYGAZ SERVICES SDN.BHD.

• Director | SIAM TANK TERMINAL COMPANY LIMITED

• Director | TROPICAL GAS PTE.LTD.

• Director | SIAM LNG COMPANY LIMITED

• Director | PACIFIC GAS BANGLADESH LTD.

• Director | ASIATECH INFRASTRUTURE COMPANY PTE.LTD.

• Director | SIAMGAS J&J INTERNATIONAL

• Director | SIAMGAS BANGLADESH LTD.

• Director | MSN INTERNATIONAL LTD.

• Director | ASIATECH ENERGY PTE.LTD.

• Director | MYANMAR LIGHTING IPP (COMPANY) LTD.

• Director | SIAMGAS GLOBAL INVESTMENT PTE.LTD.

• Director | SIAMGAS POWER PTE.LTD.

• Director | FAREAST PETROLEUM SDN.BHD.

• Director | MYGAZ SND.BHD.

• Director | CITYGAS NORTH COMPANY LIMITED

• Director | SIAM SUKSAWAT COMPANY LIMITED

• Director | SIAM OCEAN GAS AND ENERGY LIMITED

• Director | SINO SIAMGAS AND PETROCHEMICALS COMPANY LIMITED

• Director | SINGGAS (LPG) PTE.LTD.

• Director | SUPERGAS COMPANY LIMITED

• Director | SIAMGAS HK COMPANY LIMITED

• Director | SIAM QUALITY STEEL COMPANY LIMITED

• Chairman | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

• Director | BOBAE TOWER COMPANY LIMITED

• Chairman | PROMMAHARAJ LAND DEVELOPMENT COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

Common share 727,763,198 shares (39.59% of total shares)

• Holds share directly in the amount of 215,671,998 shares or equal to 11.73%

• Holds share indirectly through WW holding Company Limited in the amount of 512,091,200 shares or equal to 27.86%

Mr.Supachai Weeraborwornpong - Managing Director and Director with Authorized Signature

Started on 12 January-2006

Age : 50

Educational Credential

• M.B.A. SasinGraduate Institude of Chulalongkorn University

• B.S. Civil Engineering Michigan State University, U.S.A.

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Board Member/Management in Listed Company

• None

Position in Other Company

• Director | WW HOLDING COMPANY LIMITED

• Director | LINH GAS CYLINDER COMPANY LIMITED

• Director | FAREAST MYGAZ SERVICES SDN.BHD.

• Director | SIAM TANK TERMINAL COMPANY LIMITED

• Director | RUAMUR PTE.LTD.

• Director | SIAM LNG COMPANY LIMITED

• Director | PACIFIC GAS BANGLADESH LIMITED

• Director | ASIATECH INFRASTRUCTURE COMPANY PTE.LTD.

• Director | SOUTHERN MYANMAR DEVELOPMENT COMPANY LIMITED

• Director | ASIATECH ENERGY PTE.LTD.

• Director | MYANMAR LIGHTING (IPP) COMPANY LIMITED

• Director | PT SIAMINDO DJOJO TERMINAL

• Director | SIAMGAS J&J INTERNATIONAL

• Director | SIAMGAS BANGLADESH LIMITED

• Director | SIAMGAS GLOBAL INVESTMENT PTE.LTD.

• Director | SIAMGAS POWER PTE.LTD.

• Director | FAREAST PETROLEUM SDN.BHD.

• Director | MYGAZ SND.BHD.

• Director | CITYGAS NORTH COMPANY LIMITED

• Director | SIAM SUKSAWAT COMPANY LIMITED

• Director | GREAT CHINA MILLENNIUM (THAILAND) COMPANY LIMITED

• Director | BOVORNPONG COMPANY LIMITED

• Director | SIAM OCEAN GAS AND ENERGY LIMITED

• Director | SINO SIAMGAS AND PETROCHEMICALS COMPANY LIMITED

• Director | SINGGAS (LPG) PTE LTD.

• Director | SUPERGAS COMPANY LIMITED

• Director | SIAMGAS HK COMPANY LIMITED

• Director | SIAM QUALITY STEEL COMPANY LIMITED

• Director | SIAM ETHANOL EXPORT COMPANY LIMITED

• Managing Director | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

• Director | PROMMAHARAJ LAND DEVELOPMENT COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

Common share 102,782,000 shares (5.59% of total shares)

Mrs.Patchara Weeraborwornpong - Director and Director with Authorized Signature

Started on 12 January-2006

Age : 74

Educational Credential

• An honorary doctorate of Mahachulalongkornrajavidyalaya University

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Board Member/Management in Listed Company

• None

Position in Other Company

• Director | WW HOLDING COMPANY LIMITED

• Director | SIAM TANK TERMINAL COMPANY LIMITED

• Director | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

• Director | BOBAE TOWER COMPANY LIMITED

• Managing Director | PROM MAHARAJ LAND DEVELOPMENT COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

Common share 100,000,000 shares (5.44% of total shares)

Miss Patcharawadee Weeraborwornpong - Director and Director with Authorized Signature

Started on 12 May-2017

Age : 35

Educational Credential

• M.A. Business Management , Regents Business School London

• B.S.C. Applied Business Management, Imperial College London

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Board Member/Management in Listed Company

• None

Position in Other Company

• Director | WW HOLDING COMPANY LIMITED

• Director | TIEWTALAY COMPANY LIMITED

• Director | INFINITY NORTH SAMUI COMPANY LIMITED

• Director | INFINITY HOSPITALITY HOLDING COMPANY LIMITED

• Director | INFINITY SAMUI COMPANY LIMITED

• Director | LINH GAS CYLINDER COMPANY LIMITED

• Director | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

• Director | SIAM TANK TERMINAL COMPANY LIMITED

• Director | SIAM LNG COMPANY LIMITED

• Director | SIAM QUALITY STEEL COMPANY LIMITED

• Director | LUCKY CARRIER COMPANY LIMITED

• Director | SIAM SUKSAWAT COMPANY LIMITED

• Director | PROMMAHARAJ LAND AND DEVELOPMENT COMPANY LIMITED

• Managing Director | GREAT CHINA MILLENNIUM (THAILAND) COMPANY LIMITED.

• Director | BOVORNPONG COMPANY LIMITED

• Director | SIAM LUCKY MARINE COMPANY LIMITED

• Director | SIAM ETHANOL EXPORT COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

Common share 93,000,000 shares (5.06% of total shares)

Mr.Somchai Ko-prasobsuk - Director and Director with Authorized Signature

Started on 23 April-2013

Age : 61

Educational Credential

• Bachelor degree in Business Administration faculty of The University of the Thai Chamber of Commerce

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Board Member/Management in Listed Company

• None

Position in Other Company

• Director | PRASANSACK GAS SOLE COMPANY LIMITED

• Director | SGP (LAO) CORPORATION SOLE COMPANY LIMITED

• Director | LINH GAS CYLINDER COMPANY LIMITED

• Director | SIAM TANK TERMINAL COMPANY LIMITED

• Director | SIAM LNG COMPANY LIMITED

• Director | PT SIAMINDO DJOJO TERMINAL

• Director | SIAMGAS GLOBAL INVESTMENT PTE.LTD.

• Director | SIAM LUCKY MARINE COMPANY LIMITED

• Director | LUCKY CARRIER COMPANY LIMITED

• Director | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

Common share 15,000 shares (0.0008% of total shares)

Mr.Viroj Klangboonklong - Chairman of Audit Committee and Independent director

Started on 12 January-2006

Age : 79

Educational Credential

• Bachelor degree in Engineering faculty of Chulalongkorn University

• Master degree in Business Administration of Thammasat University

• Mechanical Engineering of Asian Institute of Technology (AIT)

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

• Directors Certificate Program (DCP)

• Audit Committee Program (ACP)

• Finance for Non-finance Director Program (FND)

Board Member/Management in Listed Company

• None

Position in Other Company

• Independent Director and Chairman of Audit Committee | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

Working experience

• Director | KAIROS COMPANY LIMITED

• Independent director and Member of Audit Committee | RATCHABURI ELECTRICITY GENERATING HOLDING PUBLIC COMPANY LIMITED

• Director General | DEPARTMENT OF ENERGY, MINISTRY OF ENERGY

• Senior Chief Engineer | DEPARTMENT OF PUBLIC WORKS, MINISTRY OF INTETROR

• Chief Engineer | DEPARTMENT OF PUBLIC WORKS, MINISTRY OF INTETROR

• Director of Division control | DEPARTMENT OF PUBLIC WORKS, MINISTRY OF INTETROR

Share holder ratio (As of 31 December-2024)

Common share 1,890,000 shares (0.10% of total shares)

Mr.Harn Chiocharn - Member of Audit Committee and Independent director

Started on 12 January-2006

Age : 78

Educational Credential

• Bachelor degree in Law faculty at Thammasat University

• Degree in government with private class 6, National Defence College

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Board Member/Management in Listed Company

• Director | INTER FAR EAST ENERGY CORPORATION PUBLIC COMPANY LIMITED

Position in Other Company

• Director | GOLD HERITAGE COMPANY LIMITED

• Director | SIAM OFFSHORE COMPANY LIMITED

• Director | SOMPRASONG MALERT COMPANY LIMITED

• Director | SOMPRASONG MARUAY COMPANY LIMITED

• Director | SCAN POWER COMPANY LIMITED

• Director | SCAN SOMMART COMPANY LIMITED

• Director | SMART TREE COMPANY LIMITED

• Director | INTER FAR EAST ENGINEERING AND CONSTRUCTION COMPANY LIMITED

• Director | SUN RENEWABLE COMPANY LIMITED

• Director | U SOLAR COMPANY LIMITED

• Director | U RENEWABLE COMPANY LIMITED

• Director | TRUE ENERGY POWER LOPBURI COMPANY LIMITED

• Director | RUNGAKERAYA ENGINEERING (SA-KAEO) COMPANY LIMITED

• Director | IS POWER GREEN COMPANY LIMITED

• Director | IS SUN FARM COMPANY LIMITED

• Director | MAE SARIANG SUANSANG COMPANY LIMITED

• Director | J.P.MANGKANG COMPANY LIMITED

• Director | GREEN POWER SOLAR COMPANY LIMITED

• Director | GREEN SOLAR FARM COMPANY LIMITED

• Director | SUN LARSO COMPANY LIMITED

• Director | WANG RUNGROJ COMPANY LIMITED

• Director | KOH TAO WIND COMPANY LIMITED

• Director | INTER FAR EAST WIND INTERNATIONAL COMPANY LIMITED

• Director | INTER FAR EAST CAP MANAGEMENT COMPANY LIMITED

• Director | INTER FAR EAST THERMAL POWER COMPANY LIMITED

• Director | SOMPRASONG INTERNATIONAL COMPANY LIMITED

• Director | GREEN ENERGY TECHNOLOGY IN (THAILAND) COMPANY LIMITED

• Director | SOMPOOM SOLAR POWER COMPANY LIMITED

• Director | J.P. SOLAR POWER COMPANY LIMITED

• Director | ISENERGY COMPANY LIMITED

• Director | SUNPARK 2 COMPANY LIMITED

• Director | SCAN INTER FAR EAST ENERGY COMPANY LIMITED

• Director | WANG KARNKHA RUNGROJ COMPANY LIMITED

• Director | MAE SARIENG SOLA COMPANY LIMITED

• Director | A.P.K. DEVELOPMENT COMPANY LIMITED

• Director | DHARA DHEVI HOTEL COMPANY LIMITED

• Director | DHARA DHEVI COMPANY LIMITED

• Director | INTER FAR EAST BUSINESS COMPANY LIMITED

• Director | CLEAN CITY COMPANY LIMITED

• Director | INTER FAR EAST SOLAR COMPANY LIMITED

• Independent Director and Member of Audit Committee | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

Working experience

• Independent director and Member of Audit Committee | THAI INDUSTRY AND ENGINEERING SERVICE PUBLIC COMPANY LIMITED

• Managing Director | BANGKOK FIRST INVESTMENT TRUST PUBLIC COMPANY LIMITED

• Advisor | BANGKOK FIRST INVESTMENT TRUST PUBLIC COMPANY LIMITED

• Director | EXPRESSWAY AUTHORITY OF THAILAND

• Director | THE MARKET ORGANIZATION MINISTRY OF INTERIOR

• Deputy Managing Director | ASSET MANAGEMENT CORPORATION

• (Acting) Managing Director | ASSET MANAGEMENT CORPORATION

• Assistant Managing Director | ASSET MANAGEMENT CORPORATION

• Director of Corporate security and Legal document | ASSET MANAGEMENT CORPORATION

Share holder ratio (As of 31 December-2024)

Common share 20,000 shares (0.001% of total shares)

Mrs.Sudjit Divari - Member of Audit Committee and Independent director

Started on 12 January-2006

Age : 76

Educational Credential

– Bachelor degree in Accounting, Faculty of Commerce and Accounting at Chulalongkorn University

– Master degree in Business Administration, Faculty of Commerce and Accounting at Thammasat University

– MBA State University of California at Fresno, U.S.A.

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

• Directors Certificate Program (DCP)

• Audit Committee Program (ACP)

• IT Governance of Cyber resilience Program (ITG)

Board Member/Management in Listed Company

• None

Position in Other Company

• Independent Director and Member of Audit Committee | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

• Independent Director, Member of Audit Committee and Member of the Nomination and Remuneration Committee | EAGLES AIR AND SEA (THAILAND) COMPANY LIMITED

Working experience

• (Acting) Chairman of the Board director and Chairman of Audit Committee | SBEY CREDIT FONCIER COMPANY LIMITED

• Independent director and Member of Audit Committee | CREDIT FONCIER LYNN PHILLIP MORTGAGE COMPANY LIMITED

• Independent director and Member of Audit Committee | NAVANAKORN PUBLIC COMPANY LIMITED

• Director and Member of Audit Committee | SINGHA ESTATE PUBLIC COMPANY LIMITED

• Director and Member of Audit Committee | RASA PROPERTY DEVELOPMENT PUBLIC COMPANY LIMITED

• Director and Chairman of Audit Committee | WAVE ENTERTAINMENT PUBLIC COMPANY LIMITED

• Executive Director | UNITED FACTORING (1993) COMPANY LIMITED

• Director and Chairman of Audit Committee | SUNWOOD INDUSTRY PUBLIC COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

• None

Mrs.Jintana Kingkaew - Secretary of the Board

Age : 64

Educational Credential

• Bachelor degree in Accountancy in Auditing Major at The University of the Thai Chamber of Commerce

• Master degree in Business Administration at Kasetsart University

• Master degree in Finance at Kasetsart University

• Certificate of Capital Market Academy (CMA)

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Position in Other Company

• Deputy Managing Director | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

Working experience

• Deputy Managing Director | SIAMGAS INDUSTRY COMPANY LIMITED

• Assistant Managing Director | SIAMGAS INDUSTRY COMPANY LIMITED

• Accounting and Finance Manager | SIAMGAS INDUSTRY COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

Common share 916,000 shares (0.05% of total shares)

MANAGEMENT

Mr.Supachai Weeraborwornpong - Managing Director

Age : 50

Educational Credential

• M.B.A. SasinGraduate Institude of Chulalongkorn University

• B.S. Civil Engineering Michigan State University, U.S.A.

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Board Member/Management in Listed Company

• None

Position in Other Company

• Director | WW HOLDING COMPANY LIMITED

• Director | LINH GAS CYLINDER COMPANY LIMITED

• Director | FAREAST MYGAZ SERVICES SDN.BHD.

• Director | SIAM TANK TERMINAL COMPANY LIMITED

• Director | RUAMUR PTE.LTD.

• Director | SIAM LNG COMPANY LIMITED

• Director | PACIFIC GAS BANGLADESH LIMITED

• Director | ASIATECH INFRASTRUCTURE COMPANY PTE.LTD.

• Director | SOUTHERN MYANMAR DEVELOPMENT COMPANY LIMITED

• Director | ASIATECH ENERGY PTE.LTD.

• Director | MYANMAR LIGHTING (IPP) COMPANY LIMITED

• Director | PT SIAMINDO DJOJO TERMINAL

• Director | SIAMGAS J&J INTERNATIONAL

• Director | SIAMGAS BANGLADESH LIMITED

• Director | SIAMGAS GLOBAL INVESTMENT PTE.LTD.

• Director | SIAMGAS POWER PTE.LTD.

• Director | FAREAST PETROLEUM SDN.BHD.

• Director | MYGAZ SND.BHD.

• Director | CITYGAS NORTH COMPANY LIMITED

• Director | SIAM SUKSAWAT COMPANY LIMITED

• Director | GREAT CHINA MILLENNIUM (THAILAND) COMPANY LIMITED

• Director | BOVORNPONG COMPANY LIMITED

• Director | SIAM OCEAN GAS AND ENERGY LIMITED

• Director | SINO SIAMGAS AND PETROCHEMICALS COMPANY LIMITED

• Director | SINGGAS (LPG) PTE LTD.

• Director | SUPERGAS COMPANY LIMITED

• Director | SIAMGAS HK COMPANY LIMITED

• Director | SIAM QUALITY STEEL COMPANY LIMITED

• Director | SIAM ETHANOL EXPORT COMPANY LIMITED

• Managing Director | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

• Director | PROMMAHARAJ LAND DEVELOPMENT COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

Common share 102,782,000 shares (5.59% of total shares)

Miss Patcharawadee Weeraborwornpong - Deputy Managing Director

Age : 35

Educational Credential

• M.A. Business Management , Regents Business School London

• B.S.C. Applied Business Management, Imperial College London

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Board Member/Management in Listed Company

• None

Position in Other Company

• Director | WW HOLDING COMPANY LIMITED

• Director | TIEWTALAY COMPANY LIMITED

• Director | INFINITY NORTH SAMUI COMPANY LIMITED

• Director | INFINITY HOSPITALITY HOLDING COMPANY LIMITED

• Director | INFINITY SAMUI COMPANY LIMITED

• Director | LINH GAS CYLINDER COMPANY LIMITED

• Director | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

• Director | SIAM TANK TERMINAL COMPANY LIMITED

• Director | SIAM LNG COMPANY LIMITED

• Director | SIAM QUALITY STEEL COMPANY LIMITED

• Director | LUCKY CARRIER COMPANY LIMITED

• Director | SIAM SUKSAWAT COMPANY LIMITED

• Director | PROMMAHARAJ LAND AND DEVELOPMENT COMPANY LIMITED

• Managing Director | GREAT CHINA MILLENNIUM (THAILAND) COMPANY LIMITED.

• Director | BOVORNPONG COMPANY LIMITED

• Director | SIAM LUCKY MARINE COMPANY LIMITED

• Director | SIAM ETHANOL EXPORT COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

Common share 93,000,000 shares (5.06% of total shares)

Mrs.Jintana Kingkaew - Deputy Managing Director/CFO

Age : 64

Educational Credential

• Bachelor degree in Accountancy in Auditing Major at The University of the Thai Chamber of Commerce

• Master degree in Business Administration at Kasetsart University

• Master degree in Finance at Kasetsart University

• Certificate of Capital Market Academy (CMA)

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Position in Other Company

• Deputy Managing Director | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

Working experience

• Deputy Managing Director | SIAMGAS INDUSTRY COMPANY LIMITED

• Assistant Managing Director | SIAMGAS INDUSTRY COMPANY LIMITED

• Accounting and Finance Manager | SIAMGAS INDUSTRY COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

Common share 916,000 shares (0.05% of total shares)

Mr.Winai Krajangyao - Assistant Managing Director

Age : 65

Educational Credential

• Bachelor degree in Engineering at Sripratum University

Other Academic

• None

Position in Other Company

• None

Share holder ratio (As of 31 December-2024)

• None

Mr.Somchai Ko-prasobsuk - Assistant Managing Director

Age : 61

Educational Credential

• Bachelor degree in Business Administration faculty of The University of the Thai Chamber of Commerce

Other Academic

• Certificate of Thai Institute of Director (IOD)

• Directors Accreditation Program (DAP)

Board Member/Management in Listed Company

• None

Position in Other Company

• Director | PRASANSACK GAS SOLE COMPANY LIMITED

• Director | SGP (LAO) CORPORATION SOLE COMPANY LIMITED

• Director | LINH GAS CYLINDER COMPANY LIMITED

• Director | SIAM TANK TERMINAL COMPANY LIMITED

• Director | SIAM LNG COMPANY LIMITED

• Director | PT SIAMINDO DJOJO TERMINAL

• Director | SIAMGAS GLOBAL INVESTMENT PTE.LTD.

• Director | SIAM LUCKY MARINE COMPANY LIMITED

• Director | LUCKY CARRIER COMPANY LIMITED

• Director | UNIQUEGAS AND PETROCHEMICALS PUBLIC COMPANY LIMITED

Share holder ratio (As of 31 December-2024)

Common share 15,000 shares (0.0008% of total shares)

Policy on Corporate Governance

The Board of directors recognizes the roles and responsibilities under the authority delegated by the shareholders to manage the Company efficiently and transparently. This is to build the confidence to all stakeholders. The company conducts business under the principles of good corporate governance as follow.

Section 1 The right of shareholders

Company recognizes and focuses on basic right of shareholders as an investor in securities and owner such as right to buy and sell, transfer the securities, the right of receiving returning profit from the company, the right to receiving the adequate information of company, right in the shareholder’s meeting in giving opinion and also making decision in something important such as providing dividend, the appointment or removal directors, appointment of auditors, the transaction which is important and affect the direction of business, the amendment of article of association, regulation of company etc.

In addition to the above fundamental rights, to company has operation in various to enhance and facilitate to using the right of shareholders as following:

- The company will provide for the annual general meeting each year, it will be held within four months after the ended-financial statement. In each meeting, the company will provide the meeting invitation with the information attached in the meeting book as in occasion for shareholders to receive advance notice before the meeting seven days and announcement in the report printed on pre-meeting for three consecutive days before the meeting date, each agenda meeting is opinion of the Board of Directors.

- In case the shareholders cannot attend the meeting by themselves, the company open an opportunity to the shareholders to give authorize to independent directors or any person as an proxy to attend the meeting on their behalf by using proxy form sent to each shareholder together with a meeting notice.

- Before the meeting date, the company invites the shareholders to give opinion and ask questions in advance of meeting day

- In the meeting, company opens an opportunity to shareholders to questioning and giving opinion to the meeting in any topic with equalization. In the shareholders’ meeting, there are directors and executives who related or attend the meeting to answer in the meeting, including there are recording questioning and important opinion in the meeting report for shareholders to check it out.

- After the meeting finished, the company shall prepare the meeting report by displaying the data correctly so that shareholders can review.

Section 2 The equality treatment of shareholders

Company’s policy is to create equality happen to shareholders in all segments. In each conducting shareholders’ meeting, the company will provide the opportunity for shareholders equally to all. Before the meeting started, Chairman will provide important information to shareholders i.e. the introduction the directors, executives, and related to the attending. The chairman of the meeting announced for opening the meeting by inform the total number /proportion of shareholders and who received the authorized from the shareholders, who attend the meeting. The chairman informs the practical way in voting and counting the vote to the shareholder before voting time. Shareholders are able to vote evenly.

The meeting is conducted in accordance with company regulations, as respectively agenda. There are proposed details in each agenda. There are showing data into consideration explicitly and will not promote the agenda of meeting without report to shareholders prior notice. The only important agenda that shareholders need to take education information before making decision. In the event that shareholders cannot attend the meeting in person, the company open the opportunity to shareholders can appoint independent directors or any person to be proxy in their attending by any proxy form that the company sent along with meeting letter.

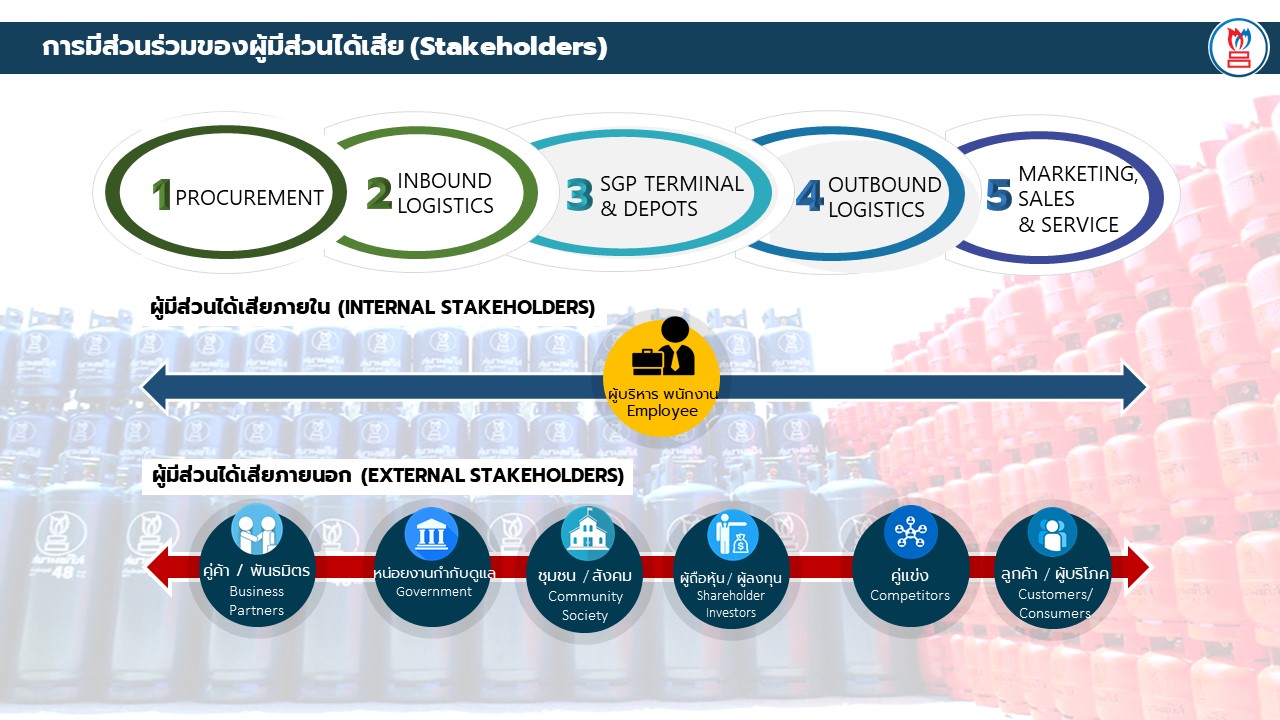

Section 3 The role of stakeholders

The company has focused on the right of all interested groups, whether they are internal stakeholder such as employees, executives of the company or external stakeholder such as competitor, customer etc. The company recognized that supporting and commenting from all stakeholders will be advantage for the operation and development of the business. Therefore, the company will practice as law and regulation determined related the right of such stakeholders with well care, besides, the company encourage to corporate between companies and group of stakeholders to secure for the company under the following guideline.

Shareholder: the company is committed to better represent the shareholders in business to create maximum satisfaction for shareholders by taking into account of the growth of value of company in long-term and actions reveal information in a transparent and credible.

Employee: the company recognized the importance of employees. This is a valuable resource of company. It aims to support the capacity development of human resources for maximum benefit. The company also encourage employees to participate in well creating corporate culture and team building and the atmosphere felling safe at work.

Competitors: the company will comply to competitor in a frame of fairly rule by keeping standard of practical to the competitors.

Clients: the company committed to meet and serve goods for satisfaction and confidence to customers. The company will comply with requirement of laws and regulations related to the right of stakeholders to be taken care well.

Section 4 Disclosure and transparency

Board of Directors recognized the important of sharing information, including financial data, general information in an accurate and complete and transparent, equitable , and time manner accordance with the rules of SEC and SET(Thailand) and other key information affecting the company’s stock price , which all influence process in a decision making of investors and stakeholders of the company. The company has disclosed the information technology of company to shareholders and investors and public via media and publishing information of the stock exchange of Thailand and the company’s website is www.siamgas.com

In the part of investors related to the company have not set up investor relation department to communicate with institution of investors, shareholders and also analyst and government related.

Board of Directors is responsible for consolidated financial statement of the company and its subsidiaries and financial information appearing in the annual report. Such financial statement prepared in accordance with general accepted accounting standard in Thailand by selection of appropriate accounting policies and compliance on a regular basis as well as disclosure adequate in the financial statement which in this audit committee will review the quality of reporting of financial and internal control systems, including, adequate disclosure of important information in the notes of financial statement.

Section 5 Responsibilities of the Board of Directors

1. Board Structure

Directors of company composed of persons who have knowledge, ability, with important role in determined the policy and overall picture of the organization and play an important role in monitoring and supervision, evaluation of operation to be as planned independently.

Structure of Board of Directors consists of 3 non-executive, of which three are independent directors, resulted in the ability to balance the power in any decision making. Moreover, 3 members of the audit committee, who are all independent, shall responsible for the business performance review.

Currently, Board of Directors composed of eight directors, 3 are non-executive and feature 3 members of independent directors and 5 are executive board.

The article of company requires that the annual general meeting, one–third of the directors, or if the number of directors is not a multiple of three, then the number nearest to one-third must retired from office. The directors retiring from office in the first and second year after the registration of the Company shall be selected by drawing lots. In subsequent years, the director who has held office longest shall retire. A director who vacates office under this section may be re-elected.

In addition, the Board of Directors has appointed various sub-committee such as audit committee and executive board and Risk Management Committee to do the specific duty and propose the topic to the Board of Directors to considered or acknowledged. The sub-committee have right and duty as set forth in authority.

The company has divided roles for responsible between Board and executives as clearly by the Board of Directors acted in policy formulation and monitoring of the executive level’s operation while the executive function in the management areas in accordance with the policy. Therefore, the Chairman of Board of directors and managing director is not the same person by both position have been selected by the Board to ensure that individuals are the best appropriate.

The company has secretary of the Board which will provide advice on regulation that Board of Directors must know and follow to in charge of activities of the Board, including with co-ordination to compliance with the resolution of committee.

2. Role, Duties, and Responsibility of the Board of Directors

The Board of Directors follow the code of conduct guidance from Stock Exchange of Thailand. The Board of Directors understand the role, duties, and responsibility and will comply with the law, objective article of association and shareholders’ resolution. The Board of Directors will work for the company benefit and will monitor the management to mange under the policy and plan within the approving budget for the best benefit of the company and shareholders.

3. Conflict of interest policy

The Board of Directors has set up conflict of interest policy to avoid the Company, subsidiaries, or related persons to approve any transaction which they have conflict of interest. The board of directors will follow the rule and regulation under the Securities and Exchange act or acquisition and disposal notification and disclosure of information regarding connected transaction notification.

The audit committee will inform the Board of Directors on connected transaction and conflict of interest in which the Board of Directors will consider the appropriateness and practice under the rule of stock exchange of Thailand. The connected transaction will be disclosed in the annual report and annual statement (Form56-1)

4. Internal control system

The company gives priority to internal control system both in executive level and practical operation level. Therefore, the company set up the duties, authority in operation to the employees and executives in written notice. This includes the controlling usage of company asset to be beneficial. The operational duties were separated in monitoring and evaluation of control from each other. The company has appointed internal audit department to monitor the internal control system. The internal audit set schedule to audit the operation of depot and filing plant at least once a year. This is to ensure the effectiveness of internal control

5. The Board of Director meeting

The company has a policy to call a Board of Director meeting at least once every three months. The company may call an extra meeting if necessary. The company will send the invitation letter with complete relating information to the directors at least seven days prior to the meeting. This is to give appropriate time for the directors to consider the information prior to the meeting. The minutes are properly prepared and the approval minutes are kept for the directors to review when needed.

6. The compensation to directors and management

The Company has set up an appropriate compensation for directors and management. The compensation rate is in an appropriate level to keep the directors and management to work with the company. The factors uses to consider the compensation rate are experience, duties, scope of work and responsibilities. The payment of compensation will follow the policy set forth by the board of directors.

7. The training for directors and management

The Board of Directors encourages all training related to corporate governance issue. This includes applying for Thai Institution of Director’s training course for directors, audit committee, management, and company secretary.

8. Following the corporate governance in other issue

• Business Ethic

The company has set up guideline on business ethic for board of directors, management, and employees to follow. The guideline will assist the management and employees to work honestly and equality to all stakeholders and public. The company announced the guideline to employees and encouraged employees to follow strictly.

• Conflict of interest

The Board of Directors has set up conflict of interest policy on the basis that all decision making should be for the highest benefit of the Company and should avoid the action which may cause the conflict of interest. The company requires all related person to report the relationship or its related transaction and the related person is not allowed to join the meeting to approve the said transaction.

The audit committee will inform the Board of Directors on connected transaction and conflict of interest in which the Board of Directors will consider the appropriateness and practice under the rule of stock exchange of Thailand. The connected transaction will be disclosed in the annual report and annual statement (Form56-1)

• Board of Directors Reporting

Audit committee will review financial report. The accounting department and auditors attended the meeting together and present financial report to the Board of Director every quarter. Board of Directors is responsible for consolidated financial statement of the company and

its subsidiaries, including financial information (report of committee responsible for financial reporting) that appear in annual report. Such financial statement prepared in accordance with accounting standard and audited by certified auditors. The disclosure of important information, and financial information and non–financial operation based on the facts and fully consistent.

Sub-Committee

Management structure of the company consists of Board of Director, Executive Board, Risk Management Committee and audit committee. The Board of Director and executives of the company are qualified according to the regulations stipulated by SET and SEC.

Authority of Board of Directors

Board of Directors has the authority to manage the Company in accordance with law, objective, article of association, and resolution of shareholders as follow.

-

- Provide the Annual General shareholders’ meeting within four months from the end of accounting period

- Provide the Board of Directors’ meeting at least once every three months.

- Provide balance sheet and financial statement of the company at end of accounting period which the auditors have been audited and proposed to the shareholder’s meeting to consider.

- Consider and approve other important transactions related to the company or any transaction which is beneficial to the company.

- Entitle to appoint Executive Board to conduct business to act on behalf of the Board of Directors or entitle to delegate the authority in proper manner and within agreed timeframe. Moreover, the Board may cancel, withdraw, make change or amend such authority.

The Board of Directors may delegate the authority to Executive board to conduct the business according to the authority and responsibilities of the Executive Board. However, such delegation shall not include any delegation of authority which will enable the Executive Board to approve any transaction in which the Executive Board or person with conflict of beneficial with the company or subsidiaries, except it is the approval to be policy or regulation that approved by the Board. - Determine the policy and strategic direction, financial management, risk management of the business. The company has provided control system to ensure that the management process in accordance with policies set forth as efficiency and effectiveness unless authority to perform the following action, only when received approved by the shareholders before proceeding, including the law requires the resolution of the meeting, increasing capital or reducing its capital, merger or liquidation of the company in all or some important parts to the other persons or take receiving liquidation of other company or private companies to become the part of company, amendment of memorandum or article of associate etc.

In addition, the Board of Directors has scope of duties for overseeing the company’s compliance, as law on Securities and Exchange Commission(SEC), term of the exchange, including making each transaction and the purchase and sale of significant assets under the rules of The Stock Exchange of Thailand or law relating to corporation business. - To consider the structure of administrative to appoint the managing director, Executive Board and other directors as its considered.

- Tracking performance according to plan and budget as continuously.

- Directors shall not operate the same conditions and to compete with company’s business or join as a part of partnership or unlimited liability partnership or a director of private company or other company that operate same condition and to complete with the company’s business. Whether they will do to benefit for themselves or to benefit for others, unless inform the shareholder’s meeting prior to the appointed.

- *Specify anti-corruption policy and practices; supervise, oversee and drive such policy and practices for actual implementation. The Administration Department shall be assigned to implement such policy and ensure that the management and the employees place importance on anti-corruption and adherence to it.

- Any other matter required by law.

*Remark: This is an additional scope and duty which is required to be approved by the Annual General Meeting of Shareholders 2017.

Authority of the audit committee

The audit committee has been delegated by the Board of Directors to responsible for checking operation of the company and report to the Board of Directors to operate the standard that will maximum benefit to the company and its subsidiaries. The scope of responsibility are as following:

The Audit committee has the duty to check and responsible as the determination and regulation of SEC and The Stock Exchange of Thailand and to report to the Board of Directors to operate standard that will cause benefit to the company and its shareholders the scope of supervision are as following :

- Ensure the company’s financial reporting accuracy and adequacy.

- Review the company’s internal control and internal audit appropriate and effective and consider the independence of audit internal unit as well as to approve the appointment, transfer, termination of internal chief agencies or other organization responsible for internal audit.

- To select and nominate independent auditors of the company and consider a remuneration of such person, including meeting with auditors without executive attended at least one time per year.

- Ensure compliance with law requirements under Securities and Exchange Act, Stock Exchange of Thailand regulation and the law relating to its business.

- Consider the related transaction or translations that may have a conflict of interest and ensure that it is comply with the law and regulation of the Stock Exchange. This is to ensure that the transaction is reasonable with best interest for the company.

- Disclose audit committee report in company annual report, in which the report must be signed by the chairman of audit committee and must contain content at least as follow.

- An opinion on the accuracy and completeness a reliable financial report of company.

- An opinion on the adequacy of its internal control system.

- An opinion on compliance with Securities and Exchange Commission (SEC) requirement or law-related company’s business.

- Comment on the appropriateness of auditors.

- Comment about items that may have conflict of interest.

- The number of the audit committee meetings, and the attendance of such meeting by each committee member.

- Overall comment or observation of audit committee from practicing in the duties as charter.

- Other transactions, according to the audit committee’s opinion that shareholders, general investors should know under the duties and responsibilities assigned by the Board of Directors

- Report audit committee’s activities to Board of Directors at least once a year.

- Review policy, measure, and guideline of anti-corruption policy. Supervise and oversee such policy and practices for actual implementation to ensure that the Company conducts business under good corporate governance and not conflict with the policy.

- Any actions assigned by the Board of Directors appointed with approval from audit committee.

Authority of the Executive Board

-

- Conduct business in accordance with the objective, articles of association and resolution of the shareholder’s meeting and the board of Directors’ meeting.

- Determine the corporate management structure to cover all the details of selection, training, hiring, and dismissal of employees, including the appropriate employees benefit with traditional practices and circumstances and consistent with existing law.

- Prepare to recommend and set goals and guideline business policy and the company’s strategy as well as authority and responsibilities of Managing Director to grant for an approval from the Board of Directors.

- Determine the strategic business plan to approval budget for corporate business and annual expenditure budget as approved by the Board of Directors. Conduct the business strategic and plan of business by all operated of Executive Board with consistent to the policy and business way that approved by Board of Directors.

- Consider and approve of authorized operation to normal business transaction such as purchasing goods, motor vehicles, supplies, equipment, and appliances etc. within the approved cost limit for each items not exceeding 100 Million baht.

- Consider and approve expenditure in the financial department capital assets, capital expenditure of the company and its subsidiaries in the amount of 200 Million baht and accumulated up to 1,000 million baht per year. If it exceed the determined amount, the Executive Board shall purpose to the Board of Directors for considerate approval.

- Has the power to approve the requested loan or any loan of the company and its subsidiaries, including the guarantor to its subsidiaries in the amount of 200 million baht and accumulated up to 1,000 million baht per year in the case of requested loan or exceed the guaranteed limits specified. The Management Directors present to Board of Directors for consideration and approval.

- Consider and approve loans to subsidiaries by the total cumulative amount of borrowing up to 500 million baht per year.

- Entitle to have business transaction with financial institution, open the bank account with financial institution and obtain guarantees from bank and financial institution, the company and its subsidiaries in the amount of 500 million baht and accumulated up to 1,500 million baht per year.

- Promote and support anti-corruption policy and practices, review appropriateness of such anti-corruption policy and practices to make them conform to the changes in business, policy, rules, notifications, regulations and legal requirements.

- Perform the other duties as assigned in each time by Board of Directors.

- The delegation of authority as referred above shall not include any delegation of authority which will enable the Executive Board or attorneys to approve any transaction in which a member of the Executive Board or person with conflict of interest may have or have conflict of interest (according to regulation of the company and by the SEC and/or The Stock Exchange of Thailand) in any manner with the Company or its subsidiaries.

Authority of Managing Director

Managing Director has authorized to operate business as assigned by the Board of Director or Executive Board under the rules and regulation of the company. However, the delegation of authority as referred shall not include any delegation of authority which will enable Managing Director or person with conflict of interest to approve any transaction in which such person may have or have conflict of interest in any manner with the Company or its subsidiaries. The Managing Director have the limit of duties as following:

-

-

- Operate and administrate the business as the policy of business plan and strategic of business that Board of Directors already approved.

- To provide authorized or assigned the other who managing director agree to doing the duty instead of managing director as necessary and appropriate the discretion of executive board under the rules, laws and regulation of company.

- Perform other duties as assigned by the Board of Director or executive board in each time.

- Operate and merge of the company’s business as usual and can approve the transaction as normal such as procurement of goods, vehicles, equipment, supplies, appliance. Expenditure approval of lease, to approve the write-off (to comply with policies and procedure of company) and hire consultants and etc. The value for each items doesn’t exceed 50 million baht.

- Consider and approve capital expenditure of the company and its subsidiaries in the amount of 100 million baht and accumulated not more than 500 million baht per year. If there is exceed amount, it provide to executive board to consideration and approval.

- The authority to approve loans to subsidiaries, each not exceeding 50 million baht or equivalent by the total cumulative amount of loans not exceeding 100 million baht per year or equivalent.

-

Nomination and Appointment of Director and Top Executives

The Company does not have the nomination committee to select person to hold position of director or top executive. However, it has nomination process for selection person to hold such position where the major shareholder and/or representative of major shareholder in each group, the qualified person in each relevant field and the independent director as well as the director and executive of the Company shall jointly nominate the qualified, capable and experienced person to support business operations of the Company and who has qualifications specified by the Public Limited Company Act B.E. 2535 for the initial stage. After that such person shall be proposed to the shareholders’ meeting for consideration and selection pursuant to the Company’s articles of associations as follows:

Audit Committee / Independent director

The company has policy to nominate audit committee and independent directors announced by Securities and Exchange Commission that torjor 39/2559 on the application and allow the offering to sell the new stock issued by the Board of Director’s meeting authorized in establishment audit committee and assigned to audit committee in three year by each audit committee must be independent directors and have qualified as the independent directors as following :

-

-

- Holding shares not more than one percent of total shares voting right of major company, subsidiaries, point venture or entities that may conflict. The count of share holding of relevant independent committee.

- Not participate as directors who manage, employee, consultant has a regular salary or authority corporate control of major company, subsidiaries, joint venture and subsidiaries same order or the entity that may have conflict.

- A person who is not a blood relationship or by registration in law in type of father, mother, spouse, brother, sister or spouse of children of management or major shareholders who have authority to control or individual who will be offered to the management or control of company or subsidiaries.

- No business relationship with company or subsidiaries or individual whom might be conflict in manner that may obstruct freedom to use their discretion and not as a major shareholder, the directors who is not as independent directors or executives of those with business relationship with major corporation, subsidiaries, or entities that may conflict.

- Not being an auditor of a major company, subsidiaries, affiliate or individual that may have conflict and not being major shareholders, non- ndependent directors, executives or partnership manager of audit company which having auditors of company, subsidiaries, joint venture or entities that may be under the conflict.

- Not being a professional in any service, including providing service as a legal consultant or financial consultant who received service charge more than 2 million baht a year from company, subsidiaries, joint venture, entities who might have conflict. In the case of professional service is legal entity including major shareholder who are not independent executive or partnership of that professional service.

- Being independent from the major shareholders of the Company or other shareholders who are related to the Company’s majority shareholders.

- Not being a director who has been assigned by the Board of Directors to decide on the operation of the company subsidiaries joint venture subsidiary company in the same order or entities that may conflict and not directors of list company which is a big company subsidiaries joint venture subsidiaries in the same order.

- No other feature that could not be commented freely about the company’s operation.

-

Nomination Criteria and Qualifications of the Audit Committee

- Must be appointed by the Board of Directors or the shareholders’ meeting

- Must be the independent director and is qualified to be the independent director, and

- Must not be the director who has been authorized by the Board of Directors to make decision on business operations of the Company, parent company, subsidiary, associate company, subsidiary in the same level, major shareholders or the controlling person of the Company and,

- Must not be the director of parent company or subsidiary in the same level of the listed company only.

- Must perform similar duties as per specified in the announcement of the Stock Exchange of Thailand Re: Qualification and scope of work of the audit committee,

- Must possess adequate knowledge to be able to perform duties as the audit committee, in addition, at least one member of the audit committee must have adequate knowledge and experiences to audit credibility of financial statement.

Board of Directors

-

-

- Board of Directors consist of at least 5 directors and more than half of directors must be resident in the Kingdom.

- At the shareholder’s meeting shall appoint directors, using the following criteria:

- Each shareholder shall have one vote for each share held.

- Each shareholder will exercise all the votes applicable under (1) to elect one or more person as directors, provided that a vote shall not be divisible.

- The candidate shall be ranked in order descending from the highest number of vote received to the lowest and shall be appointed as directors in that order, until all of the director position are filled. Where there is an equality of vote cast for candidates in descending order causing the number of directors to be exceeded, the Chairman of the meeting shall have the deciding vote.

- At every annual general meeting, one-third of the directors, or if the number of directors is not a multiple of three, then the number nearest to one-third must retire from office. The directors retiring from office in the first and second year after the registration of the Company shall be selected by drawing lots. In subsequent year, the directors who has held office longest shall retire. A director who vacates office under this section maybe re-elected.

- Any directors will resign from the position, they might submit the registration letter to the company and the resignation shall be effective from the date on which the Company received the resignation letter.

- The shareholder’s meeting may vote for any director to resign from the position prior to retirement as a resulted of the expiration of the directors’ term of office with vote not less than three in fourth of number of shareholders attending at the meeting and entitled to vote and its share combined not less than half of the number of shareholders attending the meeting and being entitled to vote.

-

Supervision on Operations of the Subsidiary and the Associate Company

The Company specified that the nomination and exercise of right to vote for selection of person to be the director of the subsidiary and the associated company is required to be approved by the Company’s Board of Directors. The person appointed as the director in the subsidiary and the associate company must perform duties for the best interest of such subsidiary or associate company.

The Company also specified that such appointed person must be firstly granted approval from the Company’s Board of Directors before he/she could pass resolution or vote in significant matter in the same level which is required to have an approval from the Board of the Director if such operation is operated by the company.

Moreover, the appointment of director to be the representative in such subsidiary or associate company must be pursuant to shareholding proportion of the Company.

Furthermore, in case of subsidiary, the Company specified that such appointed person must oversee to ensure that the subsidiary has complete and correct regulations with regards to connect transaction, acquisition and disposal of assets or undertaking of other significant transactions of such company. In addition, criteria relevant to disclosure of information and the above transaction must be applied in the same manner as those of the Company’s criteria. Supervision on maintenance of information and accounting record of the subsidiary for purpose of inspection and for compilation of the consolidated financial statement on timely manner must also be specified.

Supervision on Usage of Inside Information

The Company supervises on usage of inside information by preparing a confidentiality agreement for the employee, contractor, supplier, service provider including guest who visits the Company’s business to prevent disclosure of information or confidential news of the Company and its subsidiaries. In addition, penalty clause has been imposed to those who exploit inside information for personal gain or use such information which would damage reputation of the Company. Additional, they must not purchase, sell, transfer to receive transfer of the Company’s securities by using confidential and/or inside information and/or to enter into any other legal act by using confidential and/or inside information of the Company which can cause damage to the Company’s reputation, whether directly or indirectly.

The Company has imposed measures to prevent wrongfully use of inside information by the related person who included the director, executive and employees in the function whose work related to inside information (including his/her spouse and child under legal age). The related person is prohibited to sell or purchase the Company’s securities within 1 month prior to disclosure of quarterly and annual financial statement.

The Company provided information to the directors and the executives on their obligations to report their holding of the Company’s securities including penalty clause pursuant to the Securities and Exchange Act B.E. 2535 and the requirements of the Stock Exchange of Thailand. In the event when the director or the executive purchases or sells the Company’s securities, he/she is obligated to report his/her securities holding including securities holding by his/her spouse and child under legal age to the Office of the Securities and Exchange Commission and the Stock Exchange of Thailand pursuant to Clause 59 of the Securities and Exchange Act B.E. 2535 within 3 working days, for its acknowledgement and for further dissemination to the public.

Moreover, the Company imposed disciplinary penalty against people who exploit usage of or disclose inside information which would cause damage to the Company. Various penalties have been considered as appropriated, such as verbal warning, written warning, probation and termination of employment, by firing or discharging, as the case may be

Message from the chairman

On the oversea business, both the United States and Europe faced higher financial costs due to interest rate hikes implemented by the US Federal Reserve and the European Central Bank over the past four years to control inflation. This resulted in reduced consumer and business spending. Additionally, geopolitical tensions persisted, particularly in the Middle East and the ongoing Russia-Ukraine war, which continued from-2023, further slowing global economic growth. However, the European Central Bank and the U.S. Federal Reserve began lowering interest rates in June and September-2024, respectively, leading to subsequent reductions in policy rates across various countries. Despite these developments the Company’s LPG sales volume in international markets declined compared to the previous year. This was primarily due to lower sales in the Trading business and reduced demand in China, reflecting the overall slowdown of the global economy.

In the Corporate Governance, the Company has consistently prioritized good governance practices. In-2024 the Company was awarded the “Excellent” 5-star rating for the second consecutive year in the Corporate Governance Report of Thai Listed Companies, conducted by the Thai Institute of Directors (IOD). Additionally the Company joined the Private Sector Collective Action Coalition Against Corruption (CAC), reaffirming its commitment to ethical business practices. The Company remains dedicated to its core mission of advancing the energy business by delivering high-quality petroleum products, emphasizing safety, and driving sustainable energy operations. This includes adherence to ESG (Environment, Social, and Governance) principles to enhance sustainable business management. In alignment with its goal of supporting the transition to a low-carbon energy future, the Company promotes alternative energy use, such as the LNG-powered product transportation project and the greenhouse gas emissions control program for transport vessels. Furthermore, the Company integrates business operations with social responsibility by actively engaging in community development initiatives surrounding its facilities. In-2024 the Group was awarded an AA rating in the SET ESG Rating by the Stock Exchange of Thailand (SET) for the second consecutive year, reinforcing its ongoing commitment to sustainability management and future development.

In-2025 the Company remains committed to being a leader in the energy business by maintaining a balance between financial performance and social and environmental responsibility under the framework of sustainable development (ESG). The Company will continue to focus on leveraging technology and innovation to enhance its competitiveness and strengthen its business operations for long-term growth.

Lastly, on behalf of the Board of Directors, I would like to extend my sincere gratitude to all stakeholders, both domestically and internationally—our shareholders, investors, business partners, customers, executives, and employees—who have continuously supported the Company’s operations. The success we have achieved today is the result of collective effort, and I firmly believe that with this continued collaboration, the Company will move forward with stability. Siamgas remains dedicated to conducting its business with integrity, upholding ethical standards, and driving the energy sector toward long-term security and sustainability.

Respectfully Yours,

MR. WORAWIT WEERABORWORNPONG

Chairman of the Board

Information Disclosure Policy

Principle

Siamgas and Petrochemicals Public Company Limited (“SGP”) recognizes the importance of timely transparent appropriate and impartial disclosure of company information to shareholders potential investors and the general public so that the investment community has sufficient information to make decisions related to investment in SGP’s shares. While such information must comply with all applicable rules and regulations the Company’s sensitive and confidential information must also be protected. As a result SGP’s Information Disclosure Policy has been established to govern management and employees involved with investor relations activities with the goal to build an investor relations practice that is committed to build long-term relationship with the investment community and earn investors’ trust and confidence.

Designated Spokespersons

Managing Director Chief Financial Officer and Investor Relations Manager are the designated spokespersons. Anyone of the spokespersons is authorized to either disclose the information by him/herself or assign the task to any relevant persons.

Management of Information

The company information in this case includes quarterly financial performance operating results strategic five-year plan company’s strategy business model significant mergers and acquisition transactions or investments and any other information pertaining to significant events that can potentially impact the investment decision on the company’s shares and/or is sensitive to the share price of the company.

For any significant events, in case of a leak of information incorrect news reports or untimely disclosure of information which may lead to rumors that may have an impact on the share price and/or the performance of the company the spokespersons or assigned persons shall report the significant information to the Stock Exchange of Thailand and/or other relevant channels as appropriate for immediate rectification.

Communication Channels

Information is disclosed through the Stock Exchange of Thailand website as required. In addition the company may voluntarily disclose other information deemed important through the company website for easy access. Other channels include shareholders’ meetings analyst meetings investor conferences roadshows company visits and other investor relations activities.

The company also regularly disseminates information to customers and public through press releases and conferences. Investor Relations Department shall coordinate with the units responsible for public relations regarding mass communication strategy and procedures.

Investor Relations Department

The Investor Relations Department serves as the channel of communication between the company and its shareholders and the investment community. Investor Relations Department is responsible for preparing company information as detailed in the “Management of Information” section to be disclosed to the relevant authorities investment community and the general public as required and/or as deemed appropriate.

Code of Conduct for Investor Relations

The Company has established the investor relations department to communicate important information to the shareholders the investors the analysts both within and outside the country andother relevant agencies so that they can conveniently and equally access to the Company’s information. As main duties of the Investor Relations Department are relevant to communication and public relations with other agencies as well as disclosure of information pertaining to the Company’s performance therefore the Company has prepared the Investor Relations Code of Conduct to be used as operating guidelines and to assist operations of the Investors Relations Department which must align with ethics and principles of good corporate governance with details as follows:

1. To perform Investor Relations duties with the best knowledge and ability responsibility and professionally by adherence to righteousness and equal treatment without discrimination or favor to any particular persons

2. To strictly comply with the applicable laws notifications rules regulations and practical guidelines of the relevant supervisory authorities e.g. the Office of the Securities and Exchange Commission and the Stock Exchange of Thailand as well as the Company’s Articles of Association and policies.

3. To carefully disclose information which is significant and necessary for investment decision-making in an accurate adequate timely and fair manner to avoid misunderstanding or misinterpretation. Do not disclose information which is regarded as trade secret or confidential information which may make the Group be in disadvantageous position or loss its competitiveness

4. To open opportunities to all related parties to access and inquire relevant information

5. To maintain confidential information and do not disclose nor use the Company’s inside information which is not publicly available for personal gain and/or for other benefits wrongfully.

6. To promptly and timely respond to any question or query of shareholders investors analysts and all stakeholders.

7. Do not organize meetings or clarify any information to investors and analysts within 15 days prior to the announcement of the Company’s quarterly financial statements.

8. Do not trade the Company’s securities during the Blackout Period pursuant to the Company’s policy on protection of inside information.

-

Financial Highlights

-

Financial Statement

|

3M-2025 |

Year-2024 |

Year-2023 |

Year-2022 |

|

|---|---|---|---|---|

| STATEMENT OF INCOME (THB MILLION) | ||||

| Revenue from sale of goods and services |

19,608.72 |

84,151.17 |

90,598.94 |

102,117.25 |

| Total Revenue |

19,703.19 |

84,561.18 |

91,106.29 |

103,197.51 |

| Gross profit |

757.99 |

3,873.42 |

3,471.51 |

2,497.21 |

| EBITDA |

920.67 |

4,144.47 |

3,841.09 |

3,546.51 |

| Net profit | (loss) |

132.93 |

1,341.50 |

1,041.25 |

1,104.75 |

| Net profit | (loss)(Owners of the parent) |

125.06 |

1,318.92 |

1,017.59 |

1,070.21 |

| BALANCE SHEET | ||||

| Total assets |

53,500.90 |

56,889.78 |

52,844.75 |

47,071.62 |

| Total liabilities |

36,339.38 |

39,767.96 |

36,930.42 |

31,191.36 |

| Equity |

17,161.52 |

17,121.82 |

15,914.33 |

15,880.25 |

| – Registered share capital (Mil.THB) |

918.93 |

918.93 |

918.93 |

918.93 |

| – Issued and fully paid-up share capital (Mil.THB) |

918.93 |

918.93 |

918.93 |

918.93 |

| PROFITABILITY RATIOS (%) | ||||

| Gross profit Margin |

3.87 |

4.60 |

3.83 |

2.45 |

| EBITDA Margin |

4.67 |

4.90 |

4.22 |

3.44 |

| Net profit Margin |

0.67 |

1.59 |

1.14 |

1.07 |

| Return on Assets (ROA) |

0.24 |

2.44 |

1.92 |

2.27 |

| Return of Equity (ROE) |

0.78 |

8.12 |

6.55 |

6.76 |

| LIQUIDITY RATIOS (TIMES) | ||||

| Current Ratio |

1.20 |

1.54 |

1.31 |

1.14 |

| Quick Ratio |

0.64 |

0.70 |

0.67 |

0.65 |

| FINANCIAL POLICY RATIOS (TIMES) | ||||

| Debt to Equity |

2.12 |

2.32 |

2.32 |

1.96 |

| Interest bearing debt to Equity |

1.44 |

1.62 |

1.49 |

1.13 |

| Notes: Figures represented here are on consolidated basis | ||||

| Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | |

|---|---|---|---|---|

| Financial statement-2025 | ||||

| Financial statement-2024 | ||||

| Financial statement-2023 | ||||

| Financial statement-2022 | ||||

| Financial statement-2021 | ||||

| Financial statement-2020 | ||||

| Financial statement-2019 | ||||

| Financial statement-2018 | ||||

| Financial statement-2017 | ||||

| Financial statement-2016 | ||||

| Financial statement-2015 | ||||

| Financial statement-2014 | ||||

| Financial statement-2013 | ||||

| Financial statement-2012 | ||||

| Financial statement-2011 |

-

MAJOR SHAREHOLDER

-

DIVIDEND POLICY

-

ANNUAL GENERAL MEETING

-

PROPOSAL OF

MEETING AGENDA -

SECURITIES REGISTRAR

-

Major Shareholder

-

Dividend Policy

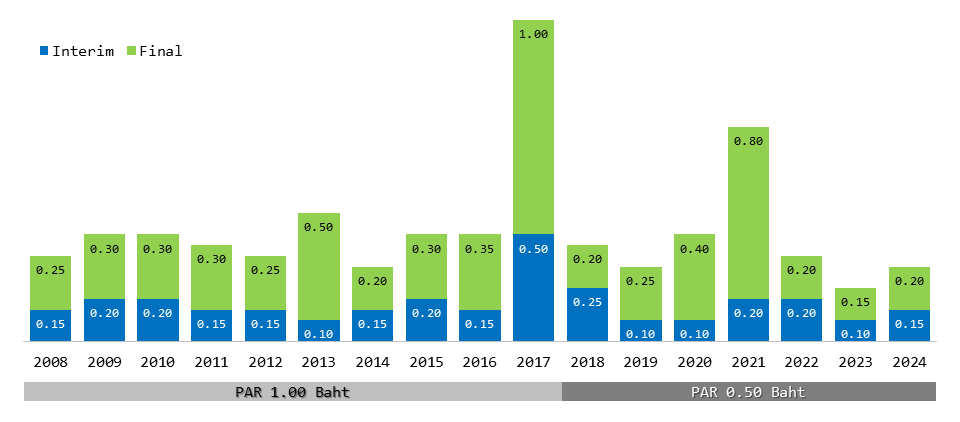

The Company has established the policy to pay dividends to the shareholders at the rate of not less than 40% of the net profit after corporate income tax, accumulated loss brought forward (if any) and appropriation of statutory reserve in accordance with the Company’s separate financial statements. However, the Board of Directors may set the rate of dividend less than the one mentioned above depending on the operating results, financial situation, liquidity and the necessity to expand the operation as well as the reserve on circulating capital of the operating of the organization.

H I S T O R I C A L D I V I D E N D P A Y M E N T

D E T A I L O F D I V I D E N D P A Y M E N T

| YEAR | PERIOD | Record Date | PAYMENT DATE | DIVIDEND PER SHARE(BAHT) |

|---|---|---|---|---|

| Y-2024 | 1 July – 31 Dec-2024 | 14 Mar-2025 | 21 May-2025 | 0.20 |

| Y-2024 | 1 Jan – 30 Jun-2024 | 23 Aug-2024 | 5 Sep-2024 | 0.15 |

| Y-2023 | 1 July – 31 Dec-2023 | 15 Mar-2024 | 20 May-2024 | 0.15 |

| Y-2023 | 1 Jan – 30 Jun-2023 | 25 Aug-2023 | 6 Sep-2023 | 0.10 |

| Y-2022 | 1 July – 31 Dec-2022 | 14 Mar-2023 | 18 May-2023 | 0.20 |

| Y-2022 | 1 Jan – 30 Jun-2022 | 25 Aug-2022 | 7 Sep-2022 | 0.20 |

| Y-2021 | 1 July – 31 Dec-2021 | 9 Mar-2022 | 17 May-2022 | 0.80 |

| Y-2021 | 1 Jan – 30 Jun-2021 | 25 Aug-2021 | 8 Sep-2021 | 0.20 |

| Y-2020 | 1 July – 31 Dec-2020 | 29 Apr-2021 | 21 May-2021 | 0.40 |

| Y-2020 | 1 Jan – 30 Jun-2020 | 26 Aug-2020 | 8 Sep-2020 | 0.10 |

| Y-2019 | 1 July – 31 Dec-2019 | 3 Mar-2020 | 14 May-2020 | 0.25 |

| Y-2019 | 1 Jan – 30 Jun-2019 | 21 Aug-2019 | 5 Sep-2019 | 0.10 |

| Y-2018 | 1 July – 31 Dec-2018 | 7 Mar-2019 | 15 May-2019 | 0.20 |

| Y-2018 | 1 Jan – 30 Jun-2018 | 20 Aug-2018 | 5 Sep-2018 | 0.25 |

| Y-2017 | 1 July – 31 Dec-2017 | 8 Mar-2018 | 9 May-2018 | 1.00 |

| Y-2017 | 1 Jan – 30 Jun-2017 | 23 Aug-2017 | 7 Sep-2017 | 0.50 |

| Y-2016 | 1 July – 31 Dec-2016 | 7 Mar-2017 | 18 May-2017 | 0.35 |

| Y-2016 | 1 Jan – 30 Jun-2016 | 23 Aug-2016 | 8 Sep-2016 | 0.15 |

| Y-2015 | 1 July – 31 Dec-2015 | 8 Mar-2016 | 17 May-2016 | 0.30 |

| Y-2015 | 1 Jan – 30 Jun-2015 | 20 Aug-2015 | 3 Sep-2015 | 0.20 |

| Y-2014 | 1 July – 31 Dec-2014 | 9 Mar-2015 | 14 May-2015 | 0.20 |

| Y-2014 | 1 Jan – 30 Jun-2014 | 20 Aug-2014 | 4 Sep-2014 | 0.15 |

| Y-2013 | 1 July – 31 Dec-2013 | 6 Mar-2014 | 15 May-2014 | 0.50 |

| Y-2013 | 1 Jan – 30 Jun-2013 | 27 Aug-2013 | 5 Sep-2013 | 0.10 |

| Y-2012 | 1 July – 31 Dec-2012 | 12 Mar-2013 | 9 May-2013 | 0.25 |

| Y-2012 | 1 Jan – 30 Jun-2012 | 28 Aug-2012 | 10 Sep-2012 | 0.15 |

-

agm

-

Document

Annual General Meeting of Shareholders

The Annual General Meeting of Shareholders on 25 April-2025 at 14.00 in the form of Electronic method (E-AGM), with the agenda as follow:

Agenda 1 : To certify the drafted minutes of The Annual General Meeting of Shareholders-2024 held on 25 April-2024

Agenda 2 : To acknowledge the operating results for the year-2024

Agenda 3 : To approve the audited financial statements for the year ended 31 December-2024

Agenda 4 : To approve the allocation of profit and dividend payment from the operating results for the year-2024

Agenda 5 : To consider the election of Directors in place of those retired by rotation.

Agenda 6 : To approve the directors remuneration for the year-2025

Agenda 7 : To approve the appointment of auditors and the determination of audit fees for the year-2025

Agenda 8 : To approve the issuance and offering of Debentures and/or Bill of Exchanges in an amount of not exceeding Baht 30,000 million (Revolving Basis)

| Invitation to E-AGM-2025 and agenda | |

| Enclosure 1 Minutes of AGM-2024 | |

| Enclosure 2 Annual Report-2024 (Form 56-1 One Report) | |

| Enclosure 3 Information of persons for directorship | |

| Enclosure 4 Definition of Independent Directors | |

| Enclosure 5 Information of Auditors | |

| Enclosure 6 Processes and Guidelines for Attending Electronic Meeting (E-AGM) | |

| Enclosure 7 User Manual for IR PLUS AGM | |

| Enclosure 8 Registration form for attending the AGM-2025 | |

| Enclosure 9.1 Proxy FORM A | |

| Enclosure 9.2 Proxy FORM B | |

| Enclosure 9.3 Proxy FORM C | |

| Enclosure 10 The Company’s Articles of Association concerning the Shareholders’ meeting | |

| Enclosure 11 Information of directors for appointing as a proxy | |

| Enclosure 12 Form for the submission of questions |

-

Document

| Criteria for Shareholders to Propose Meeting Agenda for the Annual General Meeting of Shareholders and Nomination of Candidates for Appointment as Directors for the Year-2025 |

Thailand Securities Depository Company Limited

93 Ratchadaphisek Road, Dindaeng, Bangkok 10400, Thailand

Tel: (66 2) 009 9000

Fax: (66 2) 009 9991

SET Contact Center : (66 2) 009 9999

Website: http://www.set.or.th/tsd

E-mail: SETContactCenter@set.or.th

Office Hours for TSD Counter Service

The Stock Exchange of Thailand Building

Mon – Fri: 8.30 – 17.00

Closed on Saturday, Sunday & Holidays

-

DEBENTURE DETAIL

-

CREDIT RATING

-

SECURITIES REGISTRAR

-

debenture

| ThaiBMA Symbol | Issued Date | Maturity Date | Issue Size (THB Mln.) | Outstanding (THB Mln.) | Term | Secured Type | Registered Date | TRIS |

|---|---|---|---|---|---|---|---|---|

| SGP262A PO | 26-Jan-22 | 24-Feb-26 | 4,000.00 | 4,000.00 | 4.08 Yrs | UNSECURE | 26-Jan-22 | BBB+ |

| SGP272A PO | 24-Feb-23 | 24-Feb-27 | 4,000.00 | 4,000.00 | 4.00 Yrs | UNSECURE | 24-Feb-23 | BBB+ |

| SGP282A PO | 19-Dec-23 | 19-Feb-28 | 1,728.00 | 1,728.00 | 4.17 Yrs | UNSECURE | 19-Dec-23 | BBB+ |

| SGP269A PO | 19-Dec-23 | 19-Sep-26 | 2,000.00 | 2,000.00 | 2.75 Yrs | UNSECURE | 19-Dec-23 | BBB+ |

| SGP282B PO | 7-Aug-24 | 19-Feb-28 | 2,272.00 | 2,272.00 | 3.54 Yrs | UNSECURE | 7-Aug-24 | BBB+ |

-

CREDIT RATING

| YEAR | TYPE OF CREDIT | RATING AGENCY | CREDIT RATING | RATING OUTLOOK | DOWNLOAD |

|---|---|---|---|---|---|

| 9 Jul-2025 | Company+Issue Rating | TRIS RATING | BBB,ฺBBB | Stable | |